Adverse Selection Insights

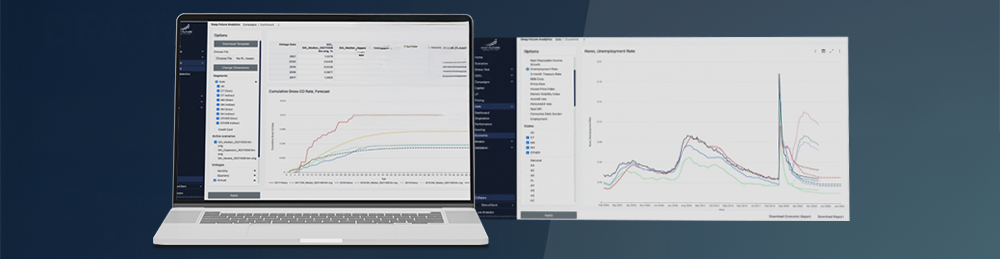

Quantified and seamlessly integrated into forecasts for smarter risk management.

Deep Future Analytics (DFA) is the result of 30 years of research and experience in credit risk analytics, in all its many aspects. With a team of 25 expert data scientists, technologists, and economists, DFA is led by Dr. Joseph Breeden, a pioneer in the field of risk modeling. Together, we equip financial institutions with actionable intelligence to drive smarter, more strategic decisions.

including delinquency, loss, and profitability; vintage-based analysis and forecasting; through-the-door distribution shifts; pricing sensitivity

for Retail Portfolios (Personal Loans, Cards, Auto, Mortgages, Small Business Loans)

credit risk modeling for transparent financial reporting.

including credit loss, yield, and NPV for smarter capital allocation.

for Risk-based pricing and Cut-off score optimization to balance risk, returns, and growth

for all loan types to aid in competitive analysis and loan origination strategy

A panel-based Origination Score connects directly to PD through the lifecycle

Coming Soon

Machine learning models for Personal Loans and Cards for the largest FinTech lender in the US

Climate risk stress testing for major US GSEs & training for ECB

Auto loan asset valuation for several top-tier US PrivateEquity firms

Asset valuation for US banks/ FinTechs for buying loan portfolios

Stress testing for several global lenders

Risk-based pricing and benchmarking project for a top auto lender in the US

Quantified and seamlessly integrated into forecasts for smarter risk management.

No overfitting in machine learning and logistic regression, ensuring accurate predictions.

Supports true product and portfolio optimization over time for sustained growth.

Cut-off scores and pricing fine-tuned to yield thresholds—no guesswork, just precision.

Traditional macroeconomic and climate risk stress tests applied down to the account level.

Empowers Strategic Recommendation Agents (SRA), the AI that businesses need.